Why Risk Management Matters for DIY Investors

For many retail investors, the thrill of picking stocks and building a portfolio independently is empowering. However, without proper risk management, DIY investors can expose themselves to devastating losses. Markets are unpredictable, and even the most promising investment thesis can fail.

Risk management is not about avoiding risk altogether—it is about understanding, controlling, and balancing it to ensure long-term survival and growth.

Common Mistakes in Risk Management

Overconcentration in Single Stocks

DIY investors often fall in love with one company or sector and put most of their money there. While conviction is important, overconcentration leaves your portfolio vulnerable to shocks.

Ignoring Market Downturns

Many investors assume bull markets will last forever. Failing to prepare for downturns can result in panic selling at the worst possible time.

Overusing Leverage

Margin trading and options can amplify gains but also magnify losses. Many DIY investors underestimate how quickly leverage can wipe out their capital.

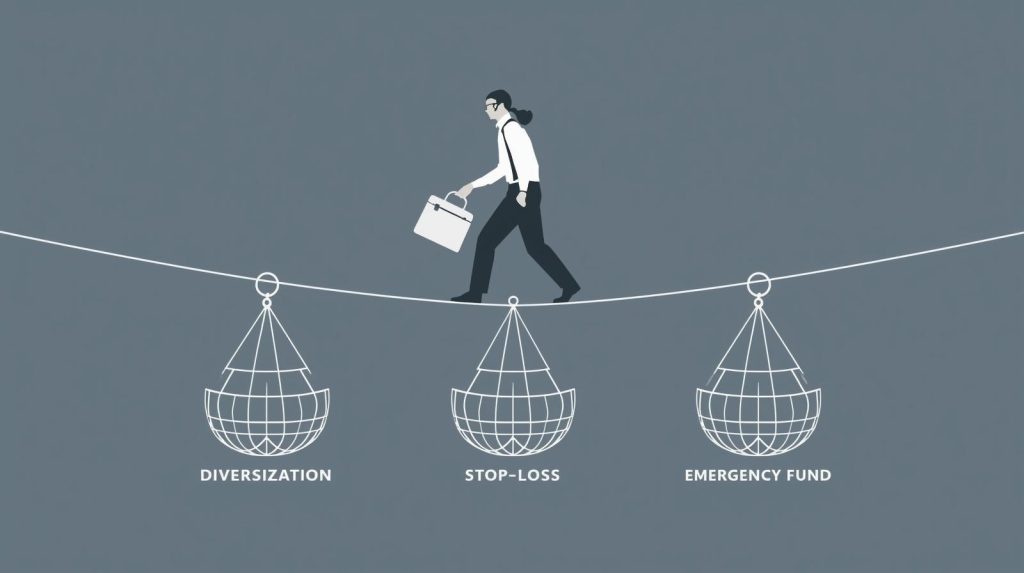

Essential Risk Management Strategies

Diversification Across Assets

Diversification remains the cornerstone of risk management. By spreading investments across stocks, bonds, real estate, and even alternative assets, DIY investors reduce the impact of any single failure. A balanced portfolio provides smoother returns and helps weather market downturns.

Position Sizing and Stop-Loss Orders

Never risk too much capital on a single trade. Position sizing—allocating only a small percentage of your portfolio to any one investment—protects against catastrophic losses. Stop-loss orders can also limit downside by automatically selling when prices fall below a set threshold.

Maintaining an Emergency Fund

An often-overlooked risk management tool is an emergency fund. Keeping 3–6 months of living expenses in cash or a savings account prevents investors from being forced to sell assets at a loss during financial stress.

Behavioral Aspects of Managing Risk

Avoiding Emotional Decisions

Fear and greed are the enemies of disciplined investing. DIY investors must resist the urge to panic sell during downturns or chase rallies during booms. Sticking to a clear investment plan helps maintain objectivity.

Sticking to a Plan During Volatility

Volatility is part of investing. A written investment plan—including asset allocation targets and risk tolerance—provides a roadmap that prevents hasty decisions in turbulent markets.

Practical Tools and Resources for DIY Investors

- Robo-advisors and apps can automate rebalancing and risk management.

- Financial calculators help estimate risk-adjusted returns.

- Educational resources (books, podcasts, courses) build awareness of common mistakes.

- Community forums provide peer insights but should be approached cautiously—always fact-check before acting.

Final Thoughts: Building Resilience in Your Portfolio

Risk management is the foundation of long-term investing success. For DIY investors, the goal is not to eliminate risk but to control it intelligently.

By diversifying assets, using stop-losses wisely, maintaining an emergency fund, and avoiding emotional pitfalls, individual investors can build portfolios that survive market turbulence and grow steadily over time.

Remember: it’s not the highest returns that win the game, but the most resilient portfolios.

Leave a Reply